Construction Accounting & Advisory Services

Optimize your construction business with expert accounting, tax, and advisory services tailored to builders and contractors. Get clarity, compliance, and growth with Numerical CPA.

Running a successful construction company is about more than just completing projects - it’s about managing complex finances, staying compliant with regulations, and making strategic decisions that fuel growth.

At Numerical CPA PC, we specialize in construction accounting and tax services designed specifically for general contractors, builders, developers and construction business owners across Canada. Our goal is to help constructors across Ontario - from the Greater Toronto Area (GTA) to Kitchener, Cambridge, Waterloo, Hamilton, and Burlington, reduce risk, increase profitability, and gain the financial clarity you need to scale with confidence.

Why Construction Businesses Need Specialized Accounting

The construction industry operates differently from most other businesses. Factors like seasonal cash flow fluctuations, project-based revenue recognition, subcontractor compliance, and strict government reporting requirements make financial management uniquely challenging.

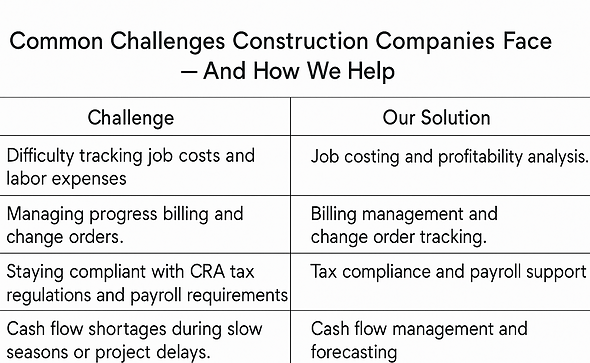

Some common challenges construction companies face include:

-

Difficulty tracking job costs and labor expenses.

-

Managing progress billing and change orders.

-

Staying compliant with CRA tax regulations and payroll requirements.

-

Cash flow shortages during slow seasons or project delays.

-

Lack of clear financial reporting for decision-making.

With Numerical CPA as your accounting partner, these challenges become manageable. We bring deep industry knowledge, advanced tools, and proactive strategies to simplify your finances and drive growth.

Comprehensive Construction Accounting Services

Our full-service accounting solutions are tailored to the unique needs of construction companies:

1. Job Costing & Project Accounting

Accurately track the costs of materials, labor, and overhead for each project.

-

Monitor real-time project profitability.

-

Identify cost overruns before they impact your bottom line.

-

Make informed bidding and pricing decisions.

2. Cash Flow Management for Construction Companies

Construction businesses often experience seasonal cash flow fluctuations.

We help you:

-

Plan for slow periods and upcoming expenses.

-

Forecast cash flow needs for ongoing and future projects.

-

Improve financial stability and avoid last-minute financing stress.

3. Tax Planning & Compliance

Avoid costly penalties and keep your tax burden low with expert guidance:

-

Corporate tax preparation and filing.

-

HST/GST compliance and reporting.

-

Strategic tax planning to maximize deductions and credits.

-

Year-round tax advisory, not just at year-end.

4. Payroll & Subcontractor Compliance

Ensure accurate, compliant payroll and subcontractor reporting:

-

Payroll processing for employees and contractors.

-

T4 and T5018 slip preparation.

-

CRA reporting and compliance management.

5. Strategic Financial Advisory

We go beyond bookkeeping - we act as your trusted financial advisor:

-

Business growth planning.

-

Profitability analysis.

-

Guidance on technology adoption for efficiency.

-

Financial strategies to win more bids and projects.