Accounting Solutions for Specialty Subcontractors

Tailored accounting and tax strategies for specialty subcontractors to stay compliant, profitable, and ready for growth.

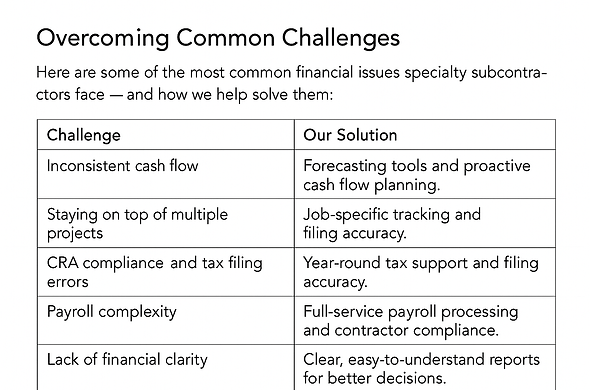

Running a successful subcontracting business is about more than providing quality workmanship - it’s about managing complex finances, staying compliant with CRA regulations, and making smart financial decisions that drive sustainable growth.

At Numerical CPA PC, we specialize in accounting and tax services for specialty subcontractors across Ontario - from the Greater Toronto Area (GTA) to Kitchener, Cambridge, Waterloo, Hamilton, and Burlington. Whether you’re a one-person operation or managing a team of tradespeople, we help you reduce risk, improve profitability, and gain financial clarity so you can focus on delivering excellent service to your clients.

Why Specialty Subcontractors Need Tailored Accounting

Subcontractors face unique financial challenges that differ from general contractors and other businesses. These include:

-

Managing irregular cash flow caused by payment delays or seasonal work.

-

Keeping track of multiple projects and contracts simultaneously.

-

HST/GST compliance and avoiding costly filing mistakes.

-

Submitting accurate T4 and T5018 forms for employees and contractors.

-

Navigating strict CRA reporting requirements for construction and subcontracting businesses.

-

Preparing for unexpected expenses like equipment repairs or project delays.

-

Without proper financial systems, these challenges can lead to lost profits, compliance issues, and unnecessary stress.

Comprehensive Accounting Solutions for Subcontractors

Our services are designed specifically for subcontractors and specialty trades, including electricians, plumbers, HVAC specialists, roofers, painters, and more.

1. Bookkeeping & Cloud Accounting

Stay organized and up-to-date with accurate records.

We help you:

-

Manage day-to-day bookkeeping with cloud-based tools.

-

Track expenses and revenue by project.

-

Get real-time access to financial data for better decision-making.

2. Cash Flow Management

Subcontracting work often means unpredictable payments.

We work with you to:

-

Forecast upcoming cash flow needs.

-

Plan for seasonal fluctuations.

-

Avoid last-minute borrowing or financial stress.

3. Tax Planning & CRA Compliance

Stay compliant and maximize tax savings with expert guidance:

-

Corporate tax preparation and filing.

-

HST/GST compliance and timely submissions.

-

Proactive tax planning to reduce liabilities.

-

Year-round advisory support, not just at tax time.

4. Payroll & Contractor Compliance

Ensure your workforce is paid accurately and in line with CRA requirements:

-

Payroll processing for employees and contractors.

-

T4 and T5018 slip preparation.

-

Subcontractor reporting and CRA compliance management.

5. Business Advisory & Growth Strategies

We go beyond basic bookkeeping to help you grow your business strategically:

-

Profitability analysis and cost control.

-

Pricing and bidding strategy support.

-

Guidance on technology adoption for efficiency.

-

Long-term business planning for sustainable growth.